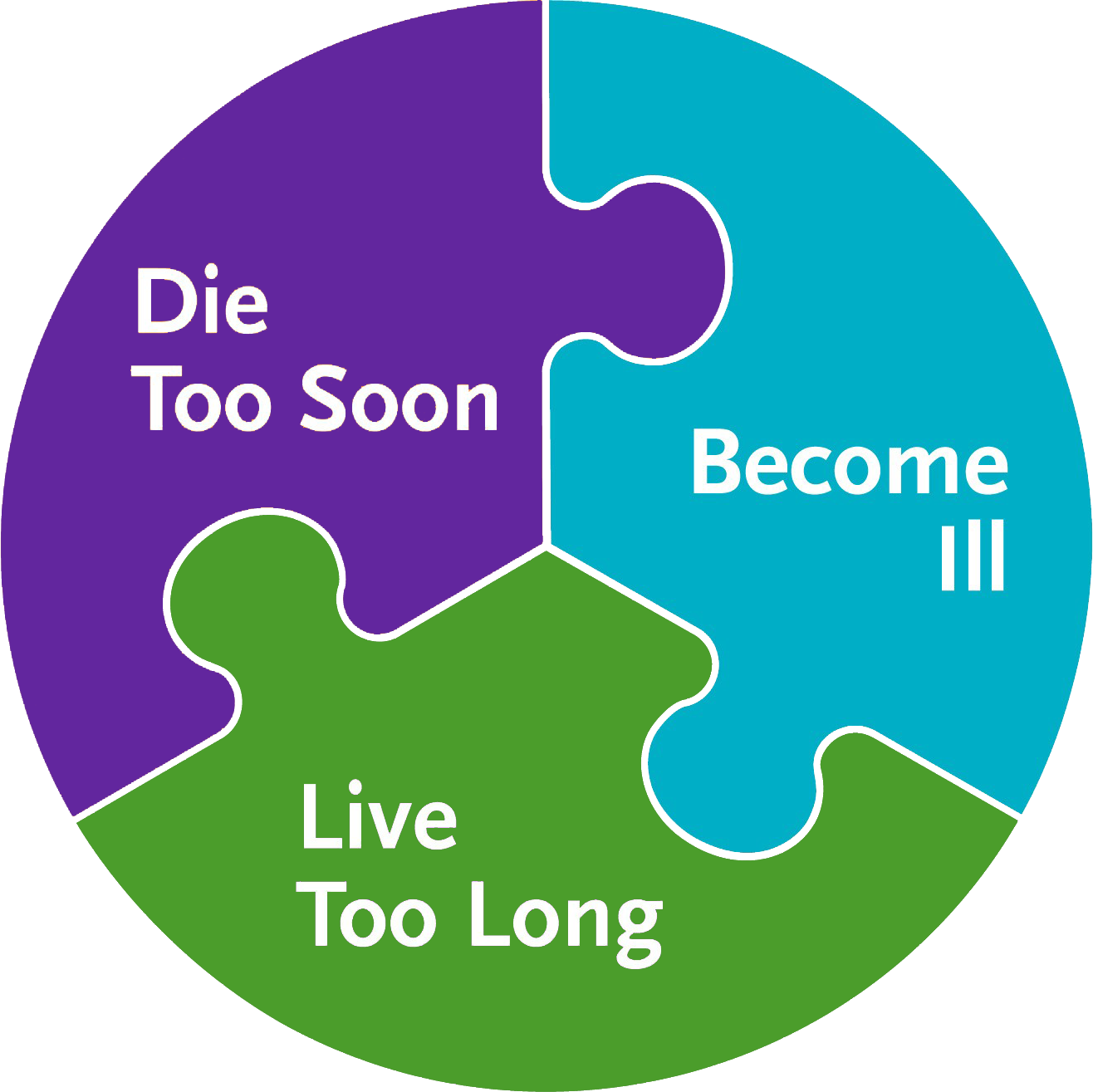

IT'S ABOUT LIFE INSURANCE THAT YOU DON'T HAVE TO DIE TO USE

Our optional Accelerated Benefits Riders provide you with access to your death benefit while you are still alive, to help cover the costs of a qualifying:

• Terminal Illness

• Chronic Illness

• Critical Illness or Critical Injury

TERMINAL ILLNESS

What qualifies?

Generally, if you have been diagnosed with a terminal illness that will result in death within 24 months of certification of the illness by a physician.

Receiving your benefit

The benefit payment will be a lump sum. There is no waiting period or annual benefit limit, but there is a lifetime limit on the amount of benefits you can receive across all Accelerated Benefits Riders.

HERE IF YOU NEED IT

You can elect to either:

• Request the full acceleration, on a discounted basis, and use the lump-sum as you wish.

• Choose to leave a portion of the policy’s death benefit intact and receive a partial benefit.

• Choose to leave the entire policy intact for your beneficiary.

CHRONIC ILLNESS

WHAT QUALIFIES?

A doctor has certified, within the past 12 months, that you are unable to perform two out of six “activities of daily living” for a period of at least 90 consecutive days without assistance, or that you are cognitively impaired.

Activities of Daily Living

1. Bathing 2. Continence 3. Dressing

4. Eating 5. Toileting 6. Transferring

RECEIVING YOUR BENEFIT

Generally, the rider needs to be in force for a period of two years. There is an annual limit on the amount of benefits you can receive.

There is also a lifetime limit on the amount of benefits you can receive across all Accelerated Benefits Riders.

HERE IF YOU NEED IT

Note that you do not have to be in a licensed facility to receive payments, and that you can apply for benefits every 12 months.

Benefits can be used for any reason (with 1 state exception), and do not need to be used for medical expenses. If you should need it, and you qualify, after the waiting period you can:

• Accelerate portions of your death benefit every year to receive benefit payments.

• Leave the policy intact for your beneficiary.

CRITICAL INJURY

CRITICAL ILLNESS

WHAT QUALIFIES?

Critical Injury includes:

• Coma

• Paralysis

• Severe Burns

• Traumatic Brain Injury

WHAT QUALIFIES?

Critical Illness includes:

• ALS (Lou Gehrig’s disease)

• Aorta Graft Surgery

• Aplastic Anemia

• Blindness

• Cancer

• Cystic Fibrosis

• End Stage Renal Failure

• Heart Attack

• Heart Valve Replacement

• Major Organ Transplant

• Motor Neuron Disease

• Stroke

• Sudden Cardiac Arrest

Receiving your benefit

The discounted benefit you receive for the critical illness or critical injury rider takes into consideration four different categories

dependent on the severity of the illness:

• Minor • Moderate

• Severe • Life Threatening

The highest payout will result from the Life Threatening category. Generally, the rider needs to be in force for 30 days prior to diagnosis in order to accelerate. There is no annual limit, but there is a lifetime limit on the amount of benefits you can receive from all Accelerated Benefits Riders.

HERE IF YOU NEED IT

You can elect to either:

• Request the full acceleration, on a discounted basis, and use the lump-sum as you wish.

• Choose to leave a portion of the policy’s death benefit intact and receive a partial benefit.

• Choose to leave the entire policy intact for your beneficiary.